Socho tumhari salary ya pocket money aayi aur kuch dinon me khatam bhi ho gayi — aur tumhe samajh hi nahi aaya paisa gaya kahan! 🤔

Isiliye Basics of Personal Finance jruri hai.

Aaj ke time me ye problem har student, fresher aur even working professional face karta hai. Isiliye personal finance samajhna bahut zaruri hai.

2025 me financial freedom sirf bade salary se nahi aata, balki smart money management se aata hai.

Is blog me hum personal finance ke basics step-by-step samjhenge jo beginners ke liye perfect hai.

What is Personal Finance?

Personal finance refers to how an individual or household manages their money. It involves various activities such as budgeting, saving, investing, and handling debt to achieve financial objectives. It covers both short-term financial needs, like managing daily expenses, and long-term goals, such as purchasing a home or planning for retirement.

- Simple shabdon me personal finance ka matlab hai apne paiso ko sahi tarike se earn – save – invest – protect karna.

Ye 4 cheezein har ek ko samajhni chahiye:

- Budgeting – apna kharcha control karna.

- Saving – future ke liye paisa alag rakhna.

- Investing – paiso ko aur paisa banane ke liye kaam pe lagana.

- Insurance – apne family aur khud ko risk se protect karna.

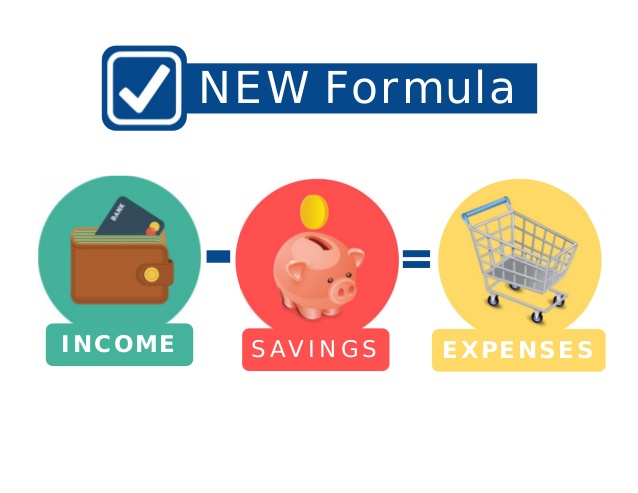

2. Golden Rule: Income – Savings = Expenses

Most log galti karte hain: Income – Expenses = Savings

Matlab pehle kharch karte hain aur jo bachta hai usse save karte hain.

✅ Sahi formula hai:

Income – Savings = Expenses

Pehle saving fix karo, baaki paisa kharch karo.

Example: Agar tumhari salary ₹25,000 hai, to minimum ₹5,000–₹6,000 save karo, aur ₹19,000 kharche ke liye bacha.

3. Step 1: Make a Budget

Ek budget tumhe control deta hai.

Sabse easy formula hai 50-30-20 Rule:

50% → Needs (Rent, food, bills)

30% → Wants (shopping, movies, eating out)

20% → Savings/Investments

👉 Tools: Free apps jaise Walnut, MoneyView, ET Money use karke apna monthly budget track kar sakte ho.

4. Step 2: Build an Emergency Fund

Life unpredictable hai — job loss, medical emergency ya family need kabhi bhi aa sakti hai.

✅ Rule:

At least 3–6 months ke expenses emergency fund me rakho.

Is fund ko sirf bank saving a/c ya FD me rakho.

Example: Agar tumhara monthly expense ₹20,000 hai, to kam se kam ₹60,000–₹1,20,000 emergency fund hona chahiye.

5. Step 3: Insurance First, Investment Later

Bahut log directly investing start kar dete hain bina insurance liye. Ye dangerous hai.

- Health Insurance – Hospital bill family ko financially disturb kar deta hai. Minimum ₹5 lakh cover lo.

- Term Insurance – Agar earning member ke sath kuch ho jaye, to family secure ho. (1 Cr cover aaj ke time me affordable hai, ₹600–₹800 monthly premium).

6. Step 4: Start Investing Early

Jitni jaldi tum invest karoge, utna compounding tumhare favour me kaam karega.

Mutual Funds SIP – ₹500 se bhi start ho sakta hai.

Equity Mutual Funds long-term ke liye best hai.

Example: Agar tum ₹3000 monthly SIP karte ho aur 10 saal tak continue karte ho, to approx ₹6–7 lakh banenge.

👉 Platforms: Groww, Zerodha Coin, ET Money, Sbi securities, angel one, Etc.

7. Step 5: Avoid Debt Trap

Credit card ya personal loan sirf emergency ke liye lo. Shopping ya lifestyle ke liye loan lena ek debt trap hai.

Minimum due pay karne ki aadat mat banao.

High interest (30–40% yearly) tumhari savings destroy kar deta hai.

Conclusion, Personal finance

Personal finance tough nahi hai, bas discipline chahiye.

Yaad rakho:

- Pehle budget banao

- Fir emergency fund build karo

- Insurance lo

- Investing start karo

- Debt trap se bacho , ab apki Personal Finance complete hua.

2025 me agar tum ye 5 steps follow karte ho, to ek strong financial life bana loge.

👉 Action Step: Aaj hi ek simple budget banao aur apni first saving account/FD/SIP start karo.

“Want more finance & career tips? Subscribe to PhoenixBuddy”.